According to CSIL, mattress retailers registered a rapid increase in online sales. Despite the issues affecting the mattress industry’s logistics and supply chains (e.g. raw materials increased prices, shipping containers global shortages, high ocean freight rates), CSIL market research unit estimates that the world e-commerce mattress market grew by 30% in 2020 over 2019.

In a recent article, CSIL partner Giulia Taveggia notes that the Pandemic has permanently accelerated mattress retailers’ shift to online sales during 2020 and the first half of 2021, compared to 2019. Pure e-tailers and online mattress companies registered double, and triple-digit increase in 2020 (eg. Amazon +38%, home24 +35%, Emma +170%, Simba Sleep +118%).

According to the CSIL’s survey launched in 2021, the United States and India registered the highest scores for e-commerce sales. In Europe, small markets such as Spain, Portugal, the Netherlands recorded the highest growth rates in online mattress sales for 2020. However, traditional markets such as Germany and the United Kingdom have continued to grow at extraordinary rates (double-digit growth).

Read E-commerce in the mattress industry. Pandemic accelerated the shift to online on www.worldfurnitureonline.com’.

Photo credit: Kljajics, CC BY-SA 4.0, via Wikimedia Commons

CSIL participated in the EU Industry Days, Europe’s flagship annual event spotlighting industrial actors and ongoing policy discussions.

On 8 February 2022, CSIL researcher Francesca Guadagno contributed to a workshop on the Textiles Ecosystem in a panel made of EURATEX, the company WOJAS SA and CITEVE - Technological Centre for Textile and Clothing Industries in Portugal. Francesca presented the recently published study on "Data on the EU textile ecosystem and its competitiveness", commissioned by DG for Internal Market, Industry, Entrepreneurship & SMEs.

The study's final report provides an assessment of opportunities and challenges faced by the EU textile ecosystem and the fashion industry regarding their competitiveness, innovation capacity, and economic relevance.

The workshop highlighted how the textile ecosystem is an asset for the EU – it generates value and innovation and showcases EU creativity and image. New challenges (import dependencies and job losses) need an urgent response. New opportunities – e-commerce and circularity – can turn the ecosystem around and become new sources of long-term competitiveness.

Read the study on Data on the EU textile ecosystem and its competitiveness

According to CSIL, the European upholstered furniture production accounts for around 14 billion EUR, a value that has cumulatively grown by 10% in the last decade. Still, in the same period, the growth registered at the world level was faster, sustained by the rapid development of production in Asia. In the global context, competition has intensified. Europe continues to be a relevant player, covering around one-fifth of world production. Despite its share on world production decreased to 19% in 2020 from 27% in 2010, Europe remains a strong competitor in the global environment.

In a context featured by continuous pressure on prices favouring, among others, countries with lower labour costs, product innovation strategies become a more critical driver of competitiveness for European companies.

CSIL partner Alessandra Tracogna discusses product innovation as a strategy to differentiate on the market. Personalisation multi-functionality sustainability emerged as market trends accentuated in the COVID era. The R&D and technical departments lead the product innovation process that goes far beyond research in style and design and involves collaborations with component suppliers, adding functions adapting to new usages.

Read Product innovation: driver of competitiveness for upholstery in Europe on World Furniture Online.

Photo credit: Polina Zimmerman from Pexels.

On 25-26 January, CSIL participated in the 14th European Space Conference, a high-level conference gathering European space domain stakeholders from the public and private sector. The conference hosted dynamic and thought-provoking debates and exchanges around the theme “A New Era for European Space: Turning Vision into Action”.

The event was an occasion to take stock of the programmes and frameworks established in the last few years – notably the EU Space Programme. It also featured first-hand insights into new priorities and initiatives – from the EU Secure Connectivity initiative to the European Alliance on Space Launchers to Destination Earth. The European space sector faces several challenges and opportunities to reinforce Europe’s strategic and defence positioning, push the boundaries of science and research, and provide data and services for the Green and Digital transition.

During the conference, the European Commissioner for the Internal Market Thierry Breton also launched the Cassini Seed and Growth Funding Facility, a €1 billion EU space investment fund to support start-ups in the space sector and crowd-in European private investors.

For years, CSIL has been developing and applying sound methodologies for the assessment of the socio-economic impact of big science, research infrastructures, space policies and has gained in-depth knowledge of the space sector and space industry. For example, CSIL is currently involved in the STARS*EU project and has contributed to an in-depth study to build an aggregated view of the Space Economy. In the past, we have investigated the feasibility and impacts of including societal criteria in the procurement activities of EU space programmes and contributed to the EU policy development process with the report Space Market Uptake in Europe, published by the European Parliament in 2016.

Photo credit: FelixMittermeier from Pixabay.

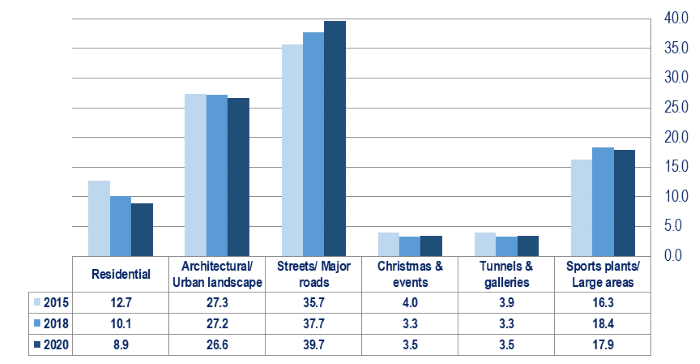

In its recently published outdoor lighting report, CSIL estimates in around 137 million units the number of outdoor lighting fixtures installed in the last year worldwide, including 3.5-4.0 million connected outdoor items.

The report considers lighting for residential use, urban landscape, Christmas and events, streets and major roads, tunnels and galleries, campus/sport. For each market segment, the research provides market size, activity trend and market shares, as well as profiles of 85 cities worldwide with a selection of economic and demographic indicators and hard facts on the potential market for outdoor lighting fixtures.

Leaders of outdoor lighting include Signify worldwide, with a market share of 7%-8%, Acuity Brands in America, Schréder in Europe, Middle East and Latin America, Panasonic Life Solutions and Tospo in Asia.

The report highlights:

Contact us for further information about the report.

The first virtual edition of the World Furniture Outlook Seminar, CSIL event presenting the latest findings on the global furniture market, its recent development and the forecasted trends, was held on 30 November 2021, with around 300 furniture professionals from over 50 World countries.

Some highlights emerged from the seminar reveal:

CSIL researchers presented furniture sector figures globally and for the main countries and for kitchen, office spaces, upholstered furniture and mattress.

Read the post-event press release.

On Wednesday 26 January, Silvia Vignetti will contribute to a webinar organised by EvalForward, a Community of Practice on Evaluation for Food Security, Agriculture and Rural Development.

The webinar will focus on how cost-benefit analysis can be used in evaluation, with practical examples in rural areas and considerations on how to use CBA to assess the efficiency criterion.

The event will take place from 15:00 to 16:00 CET on Wednesday 26 January. Participation is free, upon registration.

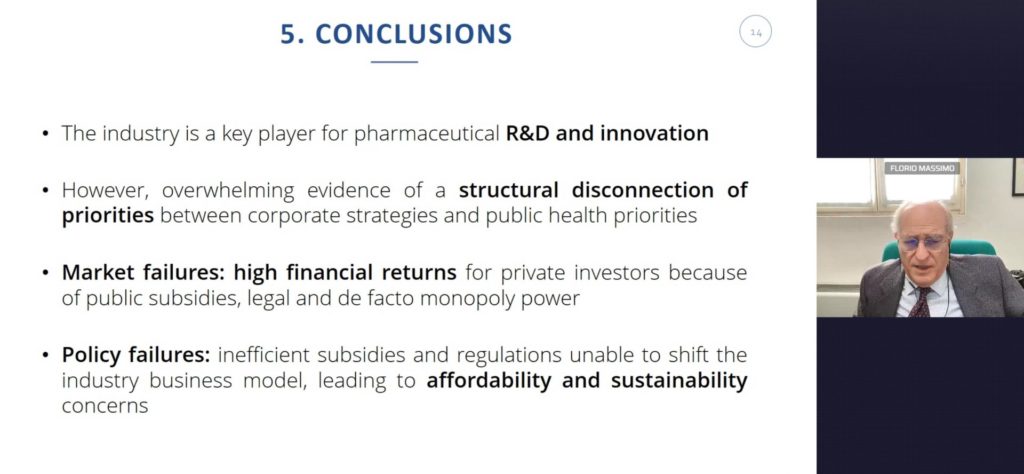

Professor Massimo Florio presented a study on European pharmaceutical R&D 'Could a public infrastructure overcome market failures?' at the European Parliament.

With a focus on research and development in innovative medicines, the study discusses a new European approach to pharmaceutical policy. After examining the European pharmaceutical sector's features, and the strengths and weaknesses of the current research and business model, it explores the need for and the concept of a European infrastructure with a long-term transboundary mission in the sign of a new role for the EU and the renunciation of private companies to exclusive patents. If adopted by the European institutions, it would place Europe as the leading global player in pharmaceutical research.

The research team led by professor Florio included CSIL economist Chiara Pancotti. The study relies on an extensive literature review and a targeted survey of international experts from science, industry, public health, and government institutions. The survey investigated the feasibility of different options in terms of the scope of the mission and legal, organisational, and financial arrangements for establishing such a European infrastructure. The study concludes by presenting a range of policy options.

CSIL Market Research Unit has issued a new edition of its report on the connected light market. It includes an analysis of main destinations (such as residential/consumer, hospitality, retail, office, institutional, healthcare, art and museum, industrial, hazardous environment, architectural outdoor lighting, street and tunnel lighting); distribution channels (projects, specialists, lifestyle, DIY, wholesalers, e-commerce); profitability (EBITDA, ROE, ROI) for around 50 players; market shares of top 50 players for LED lighting and by segment.

The report highlights:

Contact us for further information about the report.

"The impact of space procurement on suppliers: evidence from Italy" is now available online. Part of the CSIL working paper series, it has been authored by researchers from CSIL and the University of Milan, Department of Economics, Management, and Quantitative Methods.

The working paper investigates the impact of space procurement on supplier firms, stemming from the experience of a research project coordinated by the University of Milan for the Italian Space Agency.

Authors have empirically studied how public procurement affects several dimensions of firms’ performance in the Italian space industry. The research strategy implies hypothesis-validating interviews, a survey, and an econometric analysis. The study found space procurement to generate two outcomes in firms: “intermediate outcomes” - i.e., learning, innovation, and market penetration - and “final outcomes” - i.e., profit and sales,

business development, and employment – with the former inducing the latter. The results offer insights for understanding the role of public procurement from the suppliers’ perspective.

Castelnovo P, Catalano G, Giffoni F, Landoni M (2021), “The impact of space procurement on suppliers: evidence from Italy”, Working Papers 202102, CSIL Centre for Industrial Studies.