The global furniture sector faced a challenging year in 2024, shaped by economic uncertainty, geopolitical tensions, and shifting trade dynamics. According to CSIL’s World Furniture Outlook 2025, worldwide furniture consumption remained stable in current US dollars compared to 2023, though regional trends varied significantly.

Europe was among the hardest-hit regions, particularly Germany and France, where consumption declined. Despite a slowdown in inflation, economic uncertainty has continued to weigh on consumer confidence and spending. In contrast, Asia’s furniture industry has shown signs of resilience, with a gradual recovery in Chinese exports and a growing presence of Southeast Asian exporters.

From a trade perspective, 2024 was marked by complex challenges, including disruptions in maritime transport and heightened geopolitical risks. However, the global furniture trade still managed to grow by 2%, reaching an estimated USD 174 billion.

Economic conditions remain a key determinant of industry performance. According to the IMF World Economic Outlook (October 2024), global GDP growth is forecast at 3.2% for both 2024 and 2025, with emerging and developing economies outpacing advanced economies. However, the outlook is subject to several downside risks, including regional conflicts, potential economic slowdowns, financial market volatility, and shifts in international trade policies.

Political developments have further contributed to uncertainty. In 2024, elections took place in 76 countries, including key players in global trade, such as the United States, India, the United Kingdom, and members of the European Union. The impact of new policy directions on trade and economic cooperation remains a subject of close observation.

In 2024, global furniture production was estimated at USD 471 billion—unchanged from the previous year but lower than 2022 levels. While supply chain pressures have eased somewhat, full normalisation remains elusive, and the geopolitical climate continues to pose risks.

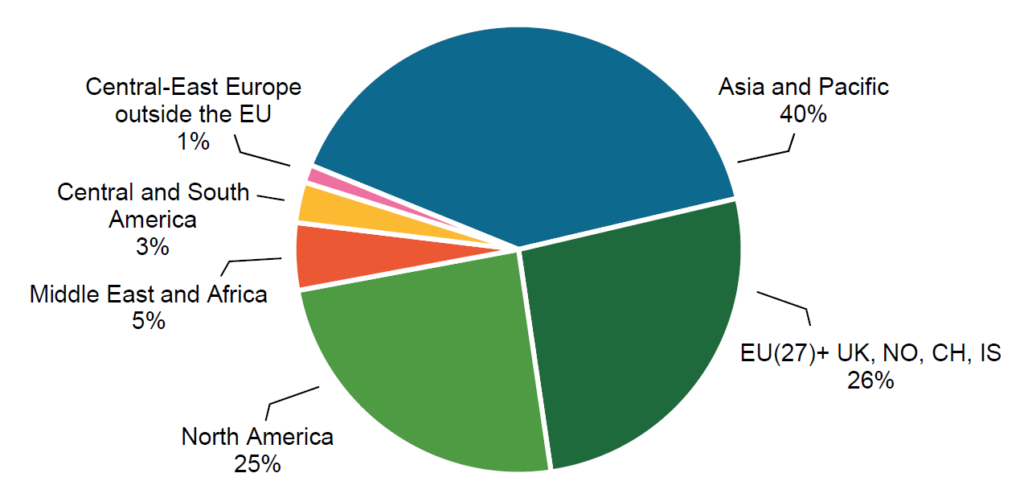

Asia and the Pacific accounted for more than half of global furniture production, with China remaining the leading producer and exporter. However, after a strong increase in exports in 2021, Chinese furniture exports declined in 2022 and 2023. Preliminary data suggest a modest recovery in 2024.

On the import side, the United States, Germany, the United Kingdom, France, and Canada remained the top furniture importers, collectively accounting for almost half of total global imports. While US furniture imports showed a slight increase in 2024, demand in European markets remained subdued due to economic uncertainty.

Trade within economic regions has been a growing trend in recent years. In Europe (EU27, the UK, Norway, Switzerland, and Iceland), approximately 75% of foreign furniture trade occurs within the region. Similar patterns are emerging in Asia and North America, partly due to near-sourcing policies and shifting supply chain strategies. If protectionist measures become more widespread, regional trade integration could accelerate further.

Looking ahead, CSIL’s World Furniture Outlook 2025 projects that global furniture consumption will increase by 1.4% in real terms in 2025. However, several uncertainties could influence these projections, including trade policy developments, global economic performance, and ongoing geopolitical tensions.

While challenges persist, the industry continues to adapt, responding to evolving consumer demand, supply chain shifts, and regulatory changes. CSIL will continue to monitor these trends, providing evidence-based insights to support decision-making in the sector.